You must be of legal drinking age to enter this site

Don't worry. Your search results will include similar terms and products to make finding your products easier and quicker.

Our Fast Order feature is a great tool that collates your most popular items and makes it easier to order them again.

22 December 2024

Important Update on Alcohol Duty Changes – What You Need to Know

On Wednesday, 30th October 2024, the Chancellor announced the new Labour Government’s first budget, which included updates to Alcohol Duty legislation. Here's what you need to know:

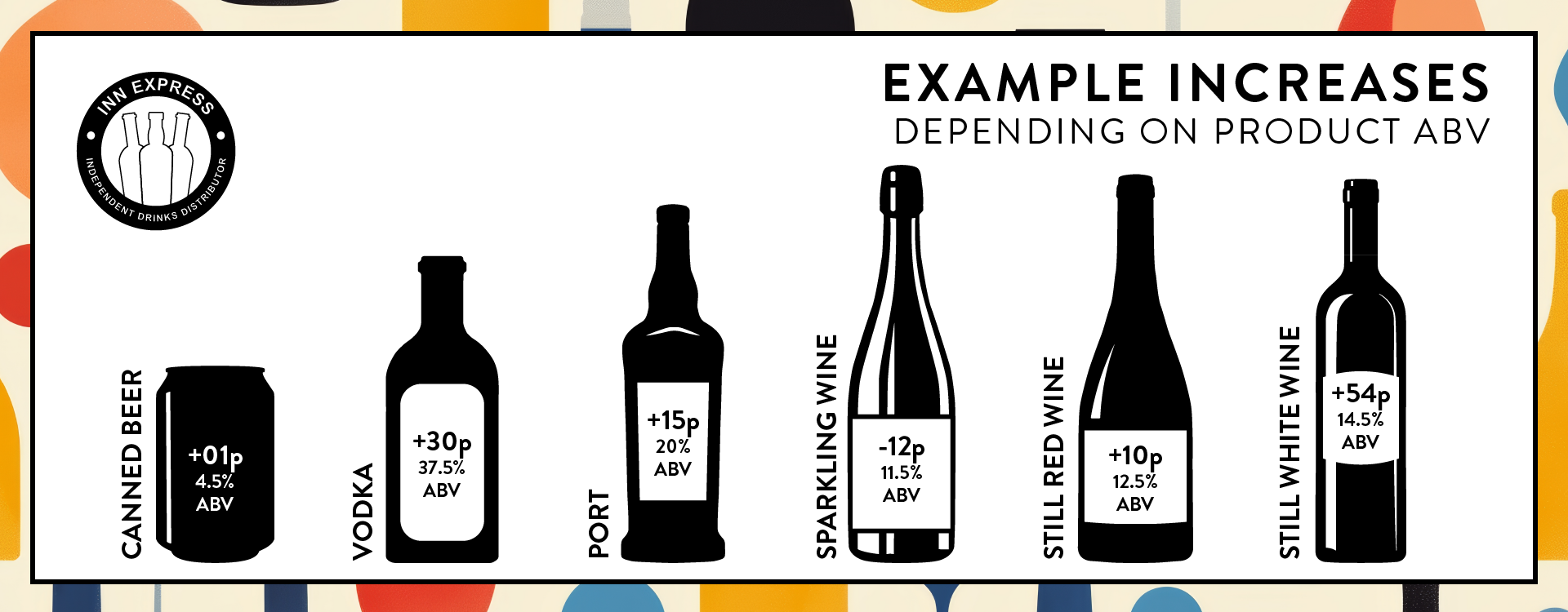

In August 2023, significant changes were made to alcohol duty legislation, introducing standardised tax bands across all types of alcoholic drinks. These bands are based on the litres of pure alcohol in the product, starting from 0.1% ABV upwards.

This reform aimed to simplify the system, reducing the number of tax bands for non-draught products from 15 to 8. However, in practice, calculating and applying duty has become more complex—each 0.1% ABV increment within a tax band results in varying duty charges. For instance, a 75cl bottle of wine with 11% ABV incurs a duty different from one at 11.1%.

To ease the transition, a temporary easement allowed wines between 11.5% and 14.5% ABV to assume a standardised strength of 12.5% ABV for duty calculations. However, starting on 1st February 2025, this easement will end.

From this date:

In simple terms, alcohol duty will rise again on 1st February. The impact will include:

This timing aligns with the annual price list updates typically released by the wine and spirits industry.

To navigate these changes, you could:

We’re here to support you through these changes. Your Account Manager is on hand to provide advice tailored to your business needs, ensuring you’re prepared with minimal disruption.

In addition, we’re working closely with our suppliers to explore opportunities in lower-ABV wines and other innovative solutions to help you create value ahead of February 2025. Keep an eye out for further updates.

If you have any questions or concerns, don’t hesitate to contact your Account Manager. We’re here to help every step of the way.